How Offshore Trust Services can Save You Time, Stress, and Money.

Wiki Article

Some Of Offshore Trust Services

Table of ContentsThe Single Strategy To Use For Offshore Trust ServicesGet This Report on Offshore Trust ServicesGetting The Offshore Trust Services To WorkSome Ideas on Offshore Trust Services You Need To KnowThe smart Trick of Offshore Trust Services That Nobody is Talking AboutThe Main Principles Of Offshore Trust Services

, the count on deed will information exactly how the international trustee need to utilize the trust's assets.The Internal Profits Solution has actually boosted security of overseas depends on in recent years, and also common tax obligation regulations still use.

The 20-Second Trick For Offshore Trust Services

Costly trustee charges can create your overseas possession security worth to lower with time, making reasonable fees a demand for a high quality trust firm. In the internet age, it's simple to discover customer evaluations on any kind of provided business. Evaluations alone may not guide your choice, however reading regarding previous clients' experiences could aid you outline inquiries to ask prospective trustees and contrast firms.Numerous legal entities provide their clients property protection solutions, yet the quality of a prospective trustee will rely on their experience with various kinds of trusts. A person who wants to establish a small household depend on will certainly have various lawful needs than somebody looking for financial investment chances. It would be best if you located a trustee that can meet the assumptions for trust fund monitoring according to your objectives.

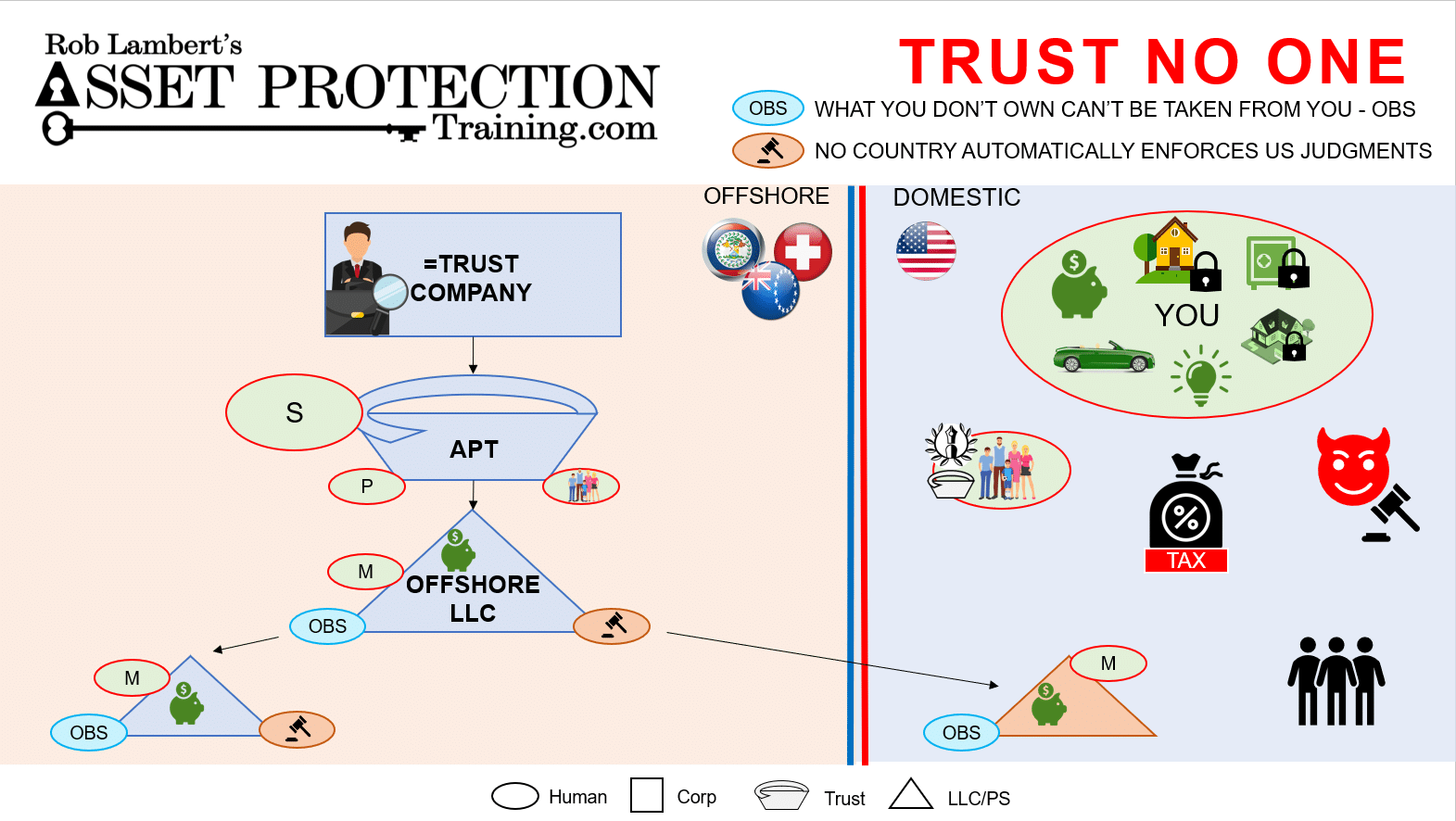

An is a lawful tool that enables an individual to securely shield their properties from financial institutions. An overseas depend on works by transferring ownership of the assets to a foreign trustee outside the territory of U.S. courts. While not required, typically the offshore trust only holds properties situated outside of the USA.

The Ultimate Guide To Offshore Trust Services

Chef Islands trust funds can be created to protect all depend on properties from U.S. civil lenders. An overseas trust fund is among the most widely known overseas asset protection planning tools. The majority of usually, an offshore trust fund is a "self-settled trust" where the trustmaker and the beneficiary are the same. The trustmaker assigns a trustee who is either a private resident of a foreign country or a trust fund firm without any U.SThe depend on has to state that the place of the count on (called the situs) governs trust provisions. The count on has to own the properties either straight or via an international entity such as an LLC that the debtor can manage when not under lawful discomfort. Find out which of your properties go to risk and just web how to safeguard them.

Not known Facts About Offshore Trust Services

Eliminates your assets from oversight of state courts. Permits you to distribute your assets effectively upon your death.

property in the name of an offshore trust fund or an offshore LLC, a united state court will still have territory over the debtor's equity and the home title because the building remains within the U.S. court's geographical jurisdiction. Offshore planning may secure united state home if the home is encumbered by a home loan to an offshore bank.

Some Ideas on Offshore Trust Services You Should Know

A possible borrower can obtain funds from an offshore financial institution, hold the funds offshore in a CD, and protect the finance this page with a lien on the property. The finance earnings may be held at an U.S. bank that is immune from garnishment, albeit making lower rate of interest rates but with more practical access to the money.A trust fund guard can be provided the power to change trustees, reapportion advantageous interests, or direct the investment of count on properties. Advisors may be international or United state individuals that have the authority to route the investment of trust properties. An offshore trust shields an U.S. borrower's possessions from United state civil judgments largely due to the fact that the trust fund's assets and its trustee are situated beyond the legal reach of United state

U.S. judges united state no authority click to compel an offshore trustee to take any action any type of activity assetsTrust fund

Cook Islands count on business are trusted, skilled, and also completely skilled. The Chef Islands are well-regarded as the premier area to establish an overseas depend on. As one of the initial countries with desirable offshore depend on laws, the Cook Islands have al lengthy history of court choices maintaining the security paid for by its depends on.

Report this wiki page